GENIUS Act - Everything you need to know

The Law That Helps Crypto and Supercharges US Power

The GENIUS Act is a huge win for crypto. But the hidden win? It increases demand for US debt, boosts US Dollar dominance, and makes it cheaper for the US to borrow

✅ Super GENIUS indeed

What is the GENIUS Act?

GENIUS stands for Guiding and Establishing National Innovation for US Stablecoins. It’s a proposed law in the US that aims to regulate stablecoins — crypto tokens that are supposed to stay at $1.

The Act aims to build a clear and safe legal framework for stablecoins.

Here’s what the GENIUS Act proposes:

Only Permitted Payment Stablecoin issuer (PPSI) to issue payment stablecoins in the US. These approved issuers must hold highly safe and liquid assets to fully back (1:1) every token.

Stablecoin reserves must be held in a separate account, can’t be used for other purposes, and are banned from rehypothecation.

Monthly reserve audits are required, done by registered public accounting firms.

Foreign companies issuing dollar-backed stablecoins in the US must follow the same rules.

Both banks and non-bank issuers (fintechs, crypto startups) are allowed.

State regulators would oversee smaller issuers. But once a company has over 10 billion dollars in circulation, it must follow federal rules and work with the Office of the Comptroller of the Currency, also known as the OCC (who manage the US banks).

The bill also clearly states that stablecoins are neither securities nor commodities. This means they are not under the control of the SEC or CFTC. Instead, they fall under the Bank Secrecy Act, which focuses on anti-money laundering rules and compliance.

Why GENIUS Act Matters?

1. The US Government Just Gave Crypto the Green Light

The GENIUS Act is a historic win for crypto. Signed into law by President Trump on July 18, it provides the first clear legal framework for payment stablecoins, signaling the US government’s commitment to digital currency innovation.

The House passed the bill with a strong 308-122 vote. What is even more surprising is that 102 Democrats joined Republicans to support it. Typically, Democrats are not seen as very crypto-friendly when it comes to regulation.

That’s rare in crypto regulation and shows the industry is no longer a partisan issue. It gives crypto a powerful stamp of legitimacy, boosting confidence among institutions and mainstream players.

2. Accelerate the amount of cash on-chain

Legal clarity means US dollars can now move on-chain through stablecoins—officially. In just one year, stablecoin market cap has already doubled from $130B to $260B (as of July 2025). And that’s without clear regulation.

Now, with the GENIUS Act, the growth in stablecoins could skyrocket.

Scott Bessent estimates stablecoins could hit $3.7 trillion by 2030. That is a potential 20x from today. This will bring more real-world purchasing power on-chain, making DeFi more attractive for businesses and users alike.

3. Increase competition in the stablecoin space

The new stablecoin law allows both banks and non-bank companies to issue stablecoins. This opens the door for much more competition.

In the past, many banks have stayed away from stablecoins due to unclear rules. Now that stablecoins will be regulated like payment products rather than securities, banks feel more confident about joining in.

Today, most crypto native people think of Circle as the main stablecoin issuer. But big banks have far more reach to non-crypto users. They already have trust and access to everyday people. If they start issuing stablecoins, mainstream adoption could accelerate quickly.

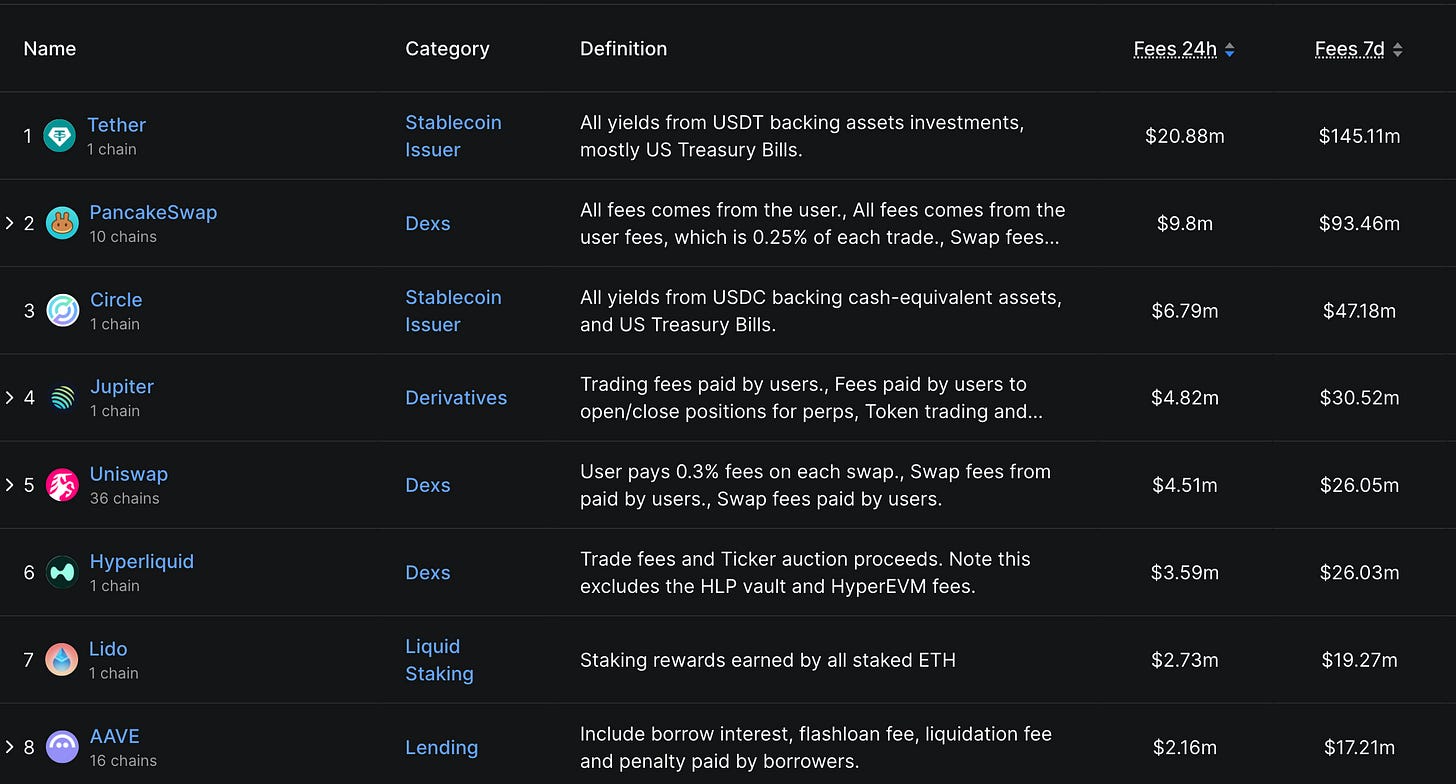

Suddenly, these traditional banks realize there is a lot of money to be made in this space. Stablecoin businesses, such as Tether, are often the top earners in the entire DeFi ecosystem. Tether generates around $ 20 million a day with a very simple business model.

Now the big banks want a piece of that and are starting to move in.

Some of the biggest banks are already making moves:

JPMorgan announced a deposit token called JPMD. CEO Jamie Dimon, once anti-crypto, now says they are open to stablecoins.

Bank of America CEO Brian Moynihan confirmed that the bank is working on a stablecoin.

Citigroup CEO Jane Fraser said the company is also exploring the space.

With these giants stepping in, the stablecoin market could become bigger, more competitive, and closely tied to the real economy.

Why Is This a Priority for the President?

The President wants the stablecoin law to achieve three main goals:

Protect consumers

Strengthen the US dollar’s global power

Deliver on his promise to make the US the crypto capital of the world

1. Protect Consumers

The GENIUS Act establishes the first federal rules to ensure the safety and trustworthiness of stablecoins.

All stablecoins must be backed 100% by liquid assets like US dollars or short-term government bonds, and issuers must publish monthly reports (showing exactly what assets they hold) to ensure safety and transparency.

Clear marketing rules stop companies from making false claims, like saying the US government backs their stablecoins or are legal tender.

If a stablecoin company goes bankrupt, customer funds get the highest priority. They must be paid back first before any other creditors or claims are paid. This provides users with strong protection and prioritizes their interests above all others.

Learning from the Failures of BlockFi and Celsius

The GENIUS Act is designed to prevent the same mistakes that led to the collapse of CeFi platforms like BlockFi and Celsius. Those companies made risky loans and lost customers' money.

This law takes a different approach. It requires stablecoin issuers to hold only safe assets, such as US Treasuries. No risky lending. This makes the system much more secure and reduces the chance of bankruptcy.

Stablecoin issuers are also not like banks. They must keep 100% of the reserves with themselves and cannot lend them out. This gives users more protection and trust.

2. Strengthen the US Dollar’s Global Power

The GENIUS Act helps boost the global strength of the US dollar. By requiring stablecoins to be backed by US dollars and Treasury securities, the law creates a steady demand for US debt. This reinforces the dollar’s role as the world’s reserve currency.

As the stablecoin market expands, it will play a more significant role in driving demand for US Treasuries. The US Treasury could become one of the biggest beneficiaries.

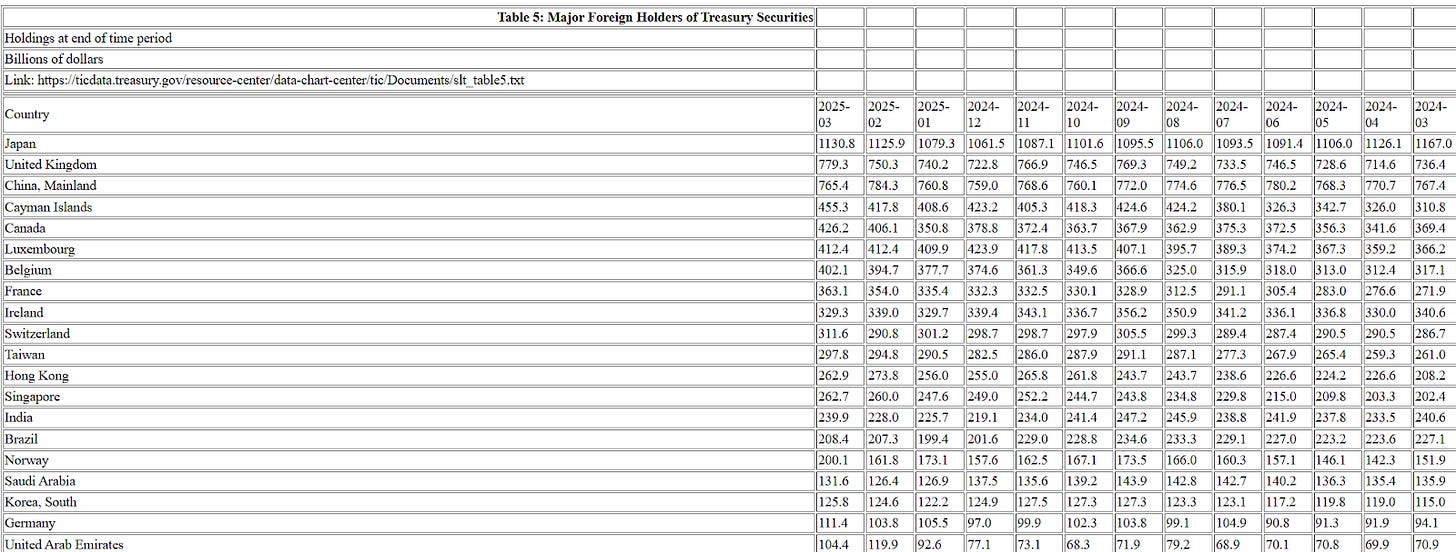

Tether now holds 120 billion dollars in US Treasuries, surpassing major countries like Germany, Canada, and Mexico. In 2024, Tether ranked as the 7th largest foreign net buyer of US Treasury securities. This shift puts a stablecoin issuer ahead of some of the world’s most prominent sovereign investors.

Mandatory T-bill backing means stablecoin issuers could become top buyers of US government debt by 2030. This would increase demand for Treasuries and help strengthen the dollar’s global position.

As BRICS countries try to reduce their reliance on the dollar, the US is taking the opposite approach. Trump aims to strengthen the dollar by generating real demand for it. While stablecoins can be issued in any currency, over 90% are currently denominated in US dollars.

The GENIUS Act is designed to make it even easier for more issuers to launch dollar-based stablecoins and support the dominance of the US dollar worldwide.

Bonus: Funding government spending

Stablecoin issuers are on he path of becoming the largest holders of US Treasuries. More demand for US Treasuries means the US government can borrow money at a cheaper rate.

3. DELIVERING ON PROMISE TO MAKE AMERICA THE CRYPTO CAPITAL OF THE WORLD:

The GENIUS Act is part of a bigger plan to embrace digital assets as a driver of economic growth and technological leadership.

In his first week in office, President Trump signed an executive order to promote US leadership in digital assets.

In March, President Trump signed another order to establish a Strategic Bitcoin Reserve and a US Digital Asset Stockpile, positioning the United States as a global leader in digital asset strategy.

Now, President Trump is building momentum by signing the GENIUS Act into law. The House has also passed the Clarity Act and the Anti-CBDC Act, both awaiting Senate approval. These actions reflect President Trump’s broader goal to make America the crypto capital of the world.

TLDR:

The GENIUS Act is a new US law that gives stablecoins a clear legal framework. Only approved companies can issue dollar-backed stablecoins. They must keep 1:1 reserves in safe assets, get monthly audits, and follow strict rules.

Stablecoins are now treated as payment tools, not securities.

This unlocks huge growth for crypto:

✅ More cash moving onchain

✅ More trust from institutions

✅ More competition as banks join the space

It also increases demand for US Treasuries, helping strengthen the dollar.

Together with Trump’s digital asset strategy, this is a significant step toward making the US the crypto capital of the world.